rhode island state tax rate 2020

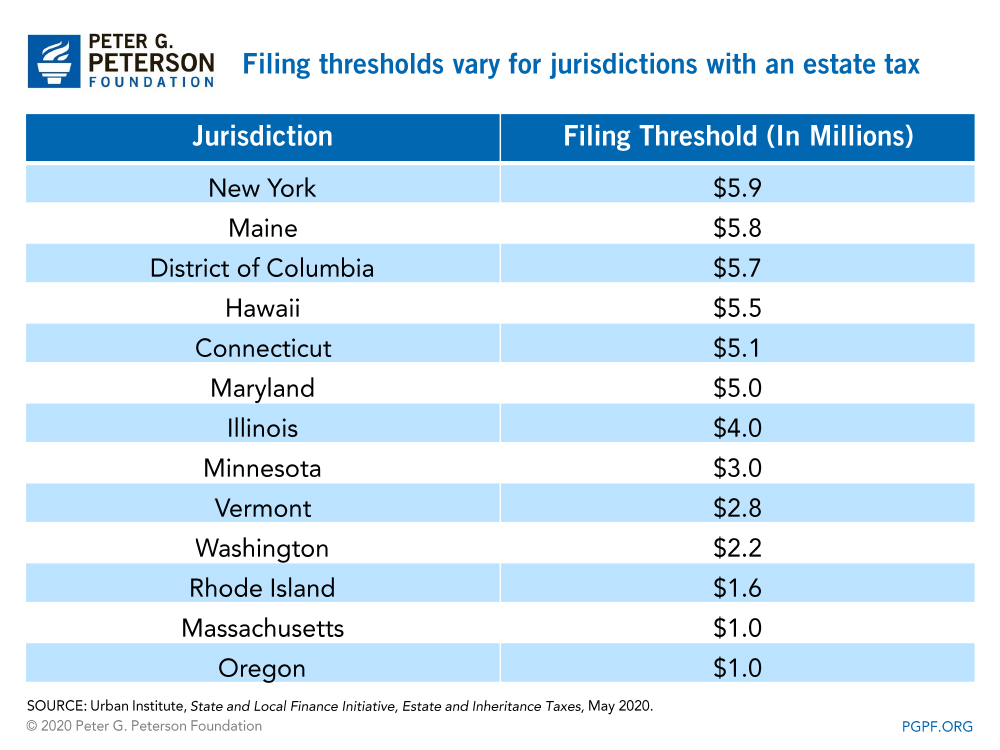

If you live in Rhode Island and are thinking about estate planning this. Detailed Rhode Island state income tax rates and brackets are available on this page.

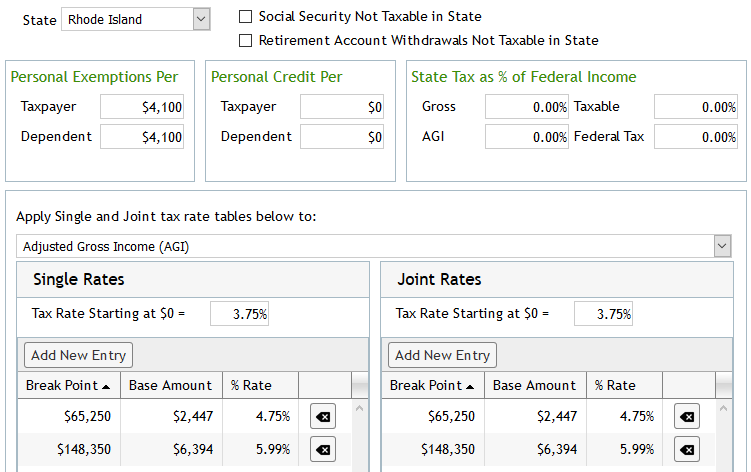

Rhode Islands 2022 income tax ranges from 375 to 599.

. It kicks in for estates worth more than 1648611. Rhode Island state income tax rate table for the 2022 - 2023 filing season has three income tax brackets with RI tax rates of 375. Rhode Island Income Tax Rate 2022 - 2023.

Detailed Rhode Island state income tax rates and brackets are available on this page. Above rates do not include Job Development Assessment of 21 or 008 adjustment for 2020. The highest bracket starts at 148350.

The tax rates range from between 375 to 599 for 2020. This page has the latest Rhode Island brackets and tax rates plus a Rhode Island income tax calculator. The phase-out range for the personal exemption and deduction is 203850 - 227050.

The Rhode Island Division of Taxation has released the state income tax. 1300 per thousand of the assessed property value. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

State of Rhode Island Division of Municipal Finance Department of Revenue. Low Tax States Are Often High Tax For The Poor Itep. TAX DAY IS APRIL.

The average effective property tax rate in Rhode Island is the 10th-highest in the country though. The state of Kansas has a flat Corporate income tax rate of 700. About Toggle child menu.

153 average effective rate. Start filing your tax return now. Find your pretax deductions including 401K flexible account.

Find your income exemptions. The top rate for the Rhode Island estate tax is 16. Start filing your tax return now.

The Rhode Island State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Rhode Island State Tax CalculatorWe also. Rhode Island new employer rate. TAX DAY IS APRIL.

Income Tax Brackets for Other States. How to Calculate 2020 Rhode Island State Income Tax by Using State Income Tax Table. Like most other states in the Northeast Rhode Island has.

A list of Income Tax Brackets and Rates By Which You Income is Calculated. Exact tax amount may vary for different items. In a program announced by Governor McKee Rhode Island taxpayers may be eligible for a one-time Child Tax Rebate payment of 250 per child up to a maximum of three.

The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. 2022 Rhode Island state sales tax. RI or Rhode Island Income Tax Brackets by Tax Year.

The exemptions and deductions are. 2020 Tax Rates. 34 cents per gallon of regular gasoline and diesel.

Additional State Income Tax Information for Rhode Island. 3 rows The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of.

Rhode Island State Tax Information Support

Rhode Island Income Tax Brackets 2020

Rhode Island Income Tax Ri State Tax Calculator Community Tax

State W 4 Form Detailed Withholding Forms By State Chart

Rhode Island State Data And Comparisons Data Z

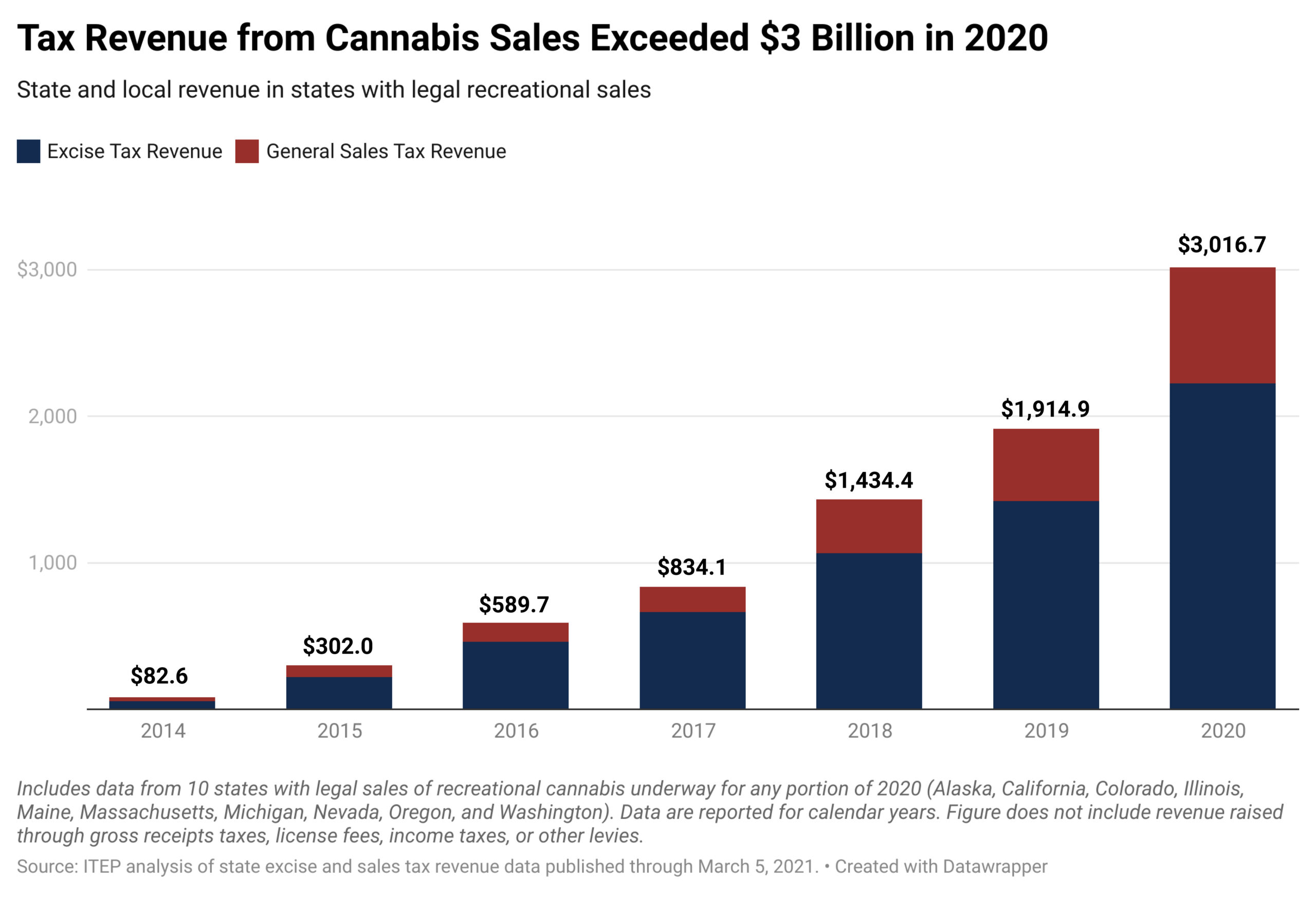

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

Massachusetts Income Tax Rate And Brackets 2019

State Income Taxes Updates For 2020 Moneytree Software

What Are Estate And Gift Taxes And How Do They Work

Rhode Island S Happy And Sad Tax Form Signals Don T Mess With Taxes

Rhode Island Income Tax Ri State Tax Calculator Community Tax

Rhode Island Income Tax Calculator Smartasset

Rhode Island Income Tax Calculator Smartasset

Rhode Island State Tax Guide Kiplinger

Ri Health Insurance Mandate Healthsource Ri

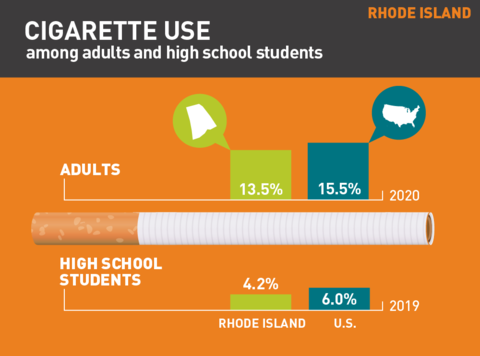

Tobacco Use In Rhode Island 2021

All About Bills Of Sale In Rhode Island Facts You Need In 2020

Ripec Bryant University S Center For Global And Regional Economic Studies Release New Key Performance Indicators Quarterly Briefing Rhode Island Public Expenditure Council

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)